ADVERTISEMENT

How to create a simple budget spreadsheet manage your money effectively. A simple budget spreadsheet can streamline your finances greatly.

This tool allows you to track your spending and savings effortlessly.

Keep reading to discover how to set up your own budget spreadsheet.

Understanding the Importance of a Budget Spreadsheet

A budget spreadsheet is essential because it helps you see where your money goes. When you can track your income and expenses, you gain control over your finances. This simple tool can turn chaos into clarity, making managing your money much easier.

With a budget spreadsheet, you can set goals for saving. You can plan for big purchases or vacations, knowing exactly how much you can spend. This not only helps you stay on track but also encourages you to save more effectively.

Lastly, a budget spreadsheet helps you identify problem areas in your spending. By reviewing your expenses, you can spot patterns that could lead to overspending. Recognizing these trends is the first step toward fixing them and building a healthier financial future.

Key Components of a Simple Budget

When creating a simple budget, the first key component is your income. This includes all the money you earn from your job, side gigs, or any other sources. Knowing your total income is essential to understanding how much you can spend each month.

Next, you need to list your expenses. These are the costs you incur regularly, like rent, groceries, and utilities. Tracking both fixed expenses and variable ones helps you see where your money is going and identify areas to cut back if necessary.

Lastly, savings should be included as a component of your budget. Setting aside money for emergencies or future goals is crucial. By including savings in your budget, you make sure that you are not just spending your income, but also preparing for what lies ahead.

Step-by-Step Guide to Create Your Spreadsheet

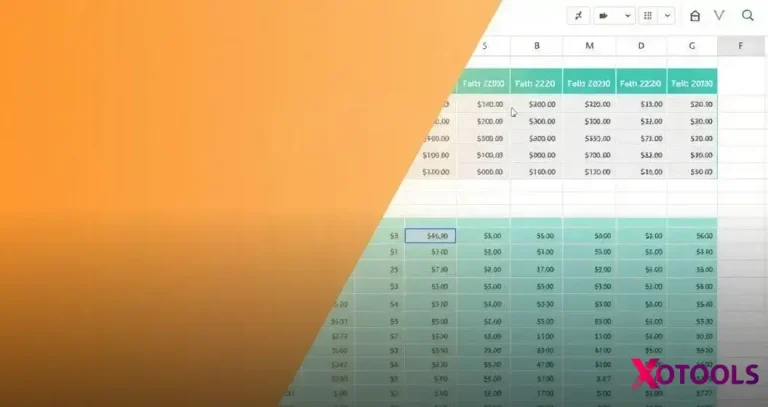

To create your budget spreadsheet, start by opening a program like Excel or Google Sheets. Create a new document and label your columns. The first column should be for your income sources, while following columns can be for various expenses and savings. This setup will be the foundation of your budget.

Next, input your expected income and expenses. Fill in your income data in the first column. Then, move to the next columns and list out all your monthly expenses. Make sure to include categories like groceries, rent, utilities, and any debt payments. This will provide an overview of your financial situation.

Once you have all your data entered, it’s time to add formulas. Use simple formulas to calculate your total income and subtract your total expenses. This will show you whether you are within your budget. Don’t forget to adjust the numbers as needed to get a balanced budget!

Tips for Customizing Your Budget

Customizing your budget can help you fit it to your needs. Start by adjusting categories based on your lifestyle. For example, if you’re a student, you might want to include education-related expenses. This will make your budget more personal and relevant to your daily life.

Another tip is to set realistic goals. If saving $500 a month seems too high, lower it to a more manageable amount. Small, achievable goals can keep you motivated and help you stick to your budget. Celebrate your savings milestones to encourage yourself.

Lastly, review your budget regularly. Life changes, and so do your expenses. By checking your budget monthly, you can adjust it for any new circumstances. This will ensure your budget always reflects your current situation and helps you stay on track.

Common Mistakes to Avoid

One common mistake people make is underestimating their expenses. It’s easy to forget small costs, like coffee or snacks. These little expenses can add up quickly and throw your budget off track. Always track all your spending, no matter how small.

Another mistake is not adjusting the budget over time. If you set your budget once and forget about it, it may no longer fit your lifestyle. Make sure to review and update your budget regularly to keep it relevant to your current financial situation.

Lastly, many forget to include savings in their budget. Treating savings as an expense is vital for financial health. Setting aside money for emergencies helps you avoid financial stress in the future. Always prioritize saving to build a secure financial future.

Tools and Software for Budgeting

There are many great tools and software for budgeting that can help simplify your financial planning. Applications like Mint allow you to track your spending automatically. It connects to your bank accounts and categorizes transactions, giving you a clear view of your finances.

Another popular choice is YNAB (You Need A Budget). This software teaches users to allocate every dollar they earn to specific expenses or savings goals. It can help you take control of your money and make informed financial decisions.

If you prefer something more hands-on, a simple Excel spreadsheet can be very effective. You can customize it however you like, adding formulas to automatically calculate totals. Plus, there are many free budget templates online to get you started!

How to Analyze Your Budget for Better Decisions

Analyzing your budget starts with tracking your actual spending against your planned budget. Look at each category closely. If you see that you’ve overspent on something like dining out, it’s time to ask why. Understanding your spending habits helps you make better choices in the future.

Next, focus on identifying patterns in your spending. Are there certain months where your expenses spike? Maybe it’s holiday season or back-to-school time. Recognizing these patterns allows you to prepare and adjust your budget accordingly for those specific times.

Lastly, evaluate your savings and financial goals regularly. Check if your budget is helping you reach your savings targets. If not, adjust your spending or savings goals. This ongoing evaluation creates a feedback loop that helps you make informed decisions and keep your finances on track.

Benefits of Using a Budget Spreadsheet

Using a budget spreadsheet provides a clear overview of your financial health. It shows you exactly how much money comes in and goes out each month. With this visibility, you can avoid surprises and manage your cash flow better.

Another benefit is accountability. When expenses are written down, you’re less likely to overspend. The spreadsheet acts as a constant reminder of your financial goals and helps you stay disciplined with your money.

Finally, a budget spreadsheet promotes long-term financial growth. By tracking your progress over time, you can measure improvements and set bigger goals. This consistent monitoring builds strong financial habits and greater confidence in managing your finances.