In the wake of economic downturns and crises, governments often turn to fiscal policy tools such as stimulus packages to stimulate growth and stabilize their economies. These packages consist of a combination of government spending, tax cuts, and other measures designed to boost consumer and business activity. They aim to provide a short-term injection of demand into the economy, thereby helping to create jobs, increase consumer spending, and support businesses.

Fiscal policy, which refers to government policies related to taxation and spending, is one of the key weapons in a government’s economic arsenal. The use of fiscal policy dates back centuries, with examples of governments using it to combat recessions and depressions dating all the way back to ancient Rome. In modern times, fiscal policy has evolved to include various forms of government stimulus packages, each with its own unique history and impact.

In this blog post, we will take a comprehensive look at government stimulus packages. We’ll explore their history, types, impact, criticisms, and controversies, as well as discuss their future potential. Through case studies and analysis, we’ll gain a deeper understanding of the role that government stimulus packages play in shaping our economies.

Overview of Government Stimulus Packages

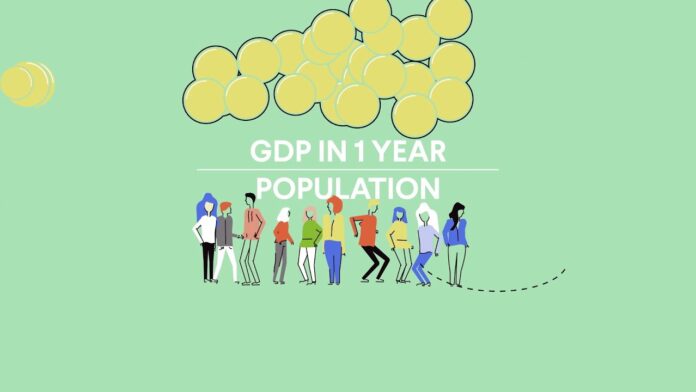

Government stimulus packages can be broadly defined as a set of measures taken by governments to boost economic activity during times of recession or crisis. These measures are usually aimed at increasing consumer spending, supporting businesses, and creating jobs. While the specifics of each package may vary, they typically involve a combination of government spending, tax cuts, and other forms of economic relief.

The rationale behind these packages is to provide a short-term boost to demand in the economy, which can help to reignite economic growth. By increasing consumer and business spending, governments hope to create a ripple effect throughout the economy. This, in turn, can lead to job creation, increased investments, and overall economic expansion.

The effectiveness of government stimulus packages has been subject to much debate and controversy. Some argue that these measures are necessary for stabilizing economies during times of crisis, while others believe they can be counterproductive and lead to long-term negative consequences. To truly understand the impact of government stimulus packages, we need to examine their history and evolution.

History of Government Stimulus Packages

The earliest form of government intervention in the economy dates back to ancient Rome, where emperors used public works programs and other policies to reduce unemployment and stimulate economic activity. In modern times, governments have relied on various forms of fiscal policy to combat economic downturns. These include tax cuts, infrastructure spending, and transfer payments such as welfare benefits and subsidies.

The first official use of the term “stimulus package” can be traced back to the New Deal, a series of economic programs initiated by President Franklin D. Roosevelt in response to the Great Depression of the 1930s. The New Deal relied heavily on government spending to create jobs and support those affected by the economic crisis.

In the post-World War II era, governments around the world continued to use fiscal policy tools, including stimulus packages, to manage their economies. However, it wasn’t until the 2008 financial crisis that government stimulus packages gained widespread attention and became a popular method for combating recessions and stimulating economic growth.

Types of Government Stimulus Packages

Government stimulus packages come in various forms, each with its own specific objectives and methods. Here are some of the most common types of stimulus packages:

Tax Cuts

Tax cuts are one of the most popular forms of government stimulus packages. By reducing taxes, governments aim to increase disposable income and encourage consumer spending. This, in turn, leads to higher demand for goods and services, which can boost economic activity. Tax cuts can also benefit businesses, as they have more funds available to invest in their operations and hire more workers.

Infrastructure Spending

Infrastructure spending refers to government investment in public works projects such as roads, bridges, and other physical structures. These projects not only create jobs but also have a long-term impact on the economy by improving productivity and efficiency. However, infrastructure spending can be time-consuming and may not provide an immediate boost to the economy.

Transfer Payments

Transfer payments are payments made by governments to individuals or businesses for various reasons, such as unemployment benefits, subsidies, and welfare programs. These payments aim to support those who have been affected by economic downturns and stimulate demand in the economy. However, they can also have unintended consequences, such as creating disincentives for people to work.

Bailouts

Bailouts refer to financial assistance provided by governments to struggling businesses. During times of crisis, governments may step in to prevent key industries from collapsing, which can have a domino effect on the economy. While bailouts may help to prevent further economic damage, they can also be controversial, as they may be seen as unfair to taxpayers who foot the bill.

Impact of Government Stimulus Packages

The impact of government stimulus packages is often difficult to measure accurately. While these measures are intended to provide a short-term boost to the economy, their long-term effects can vary greatly depending on a variety of factors. Additionally, it’s challenging to isolate the impact of a stimulus package from other external factors that may affect the economy.

One of the key ways in which government stimulus packages can have an impact is by increasing consumer spending. By putting more money into people’s pockets through tax cuts, transfer payments, or job creation, governments aim to increase demand for goods and services. This can help to boost the revenue of businesses, leading to increased investments, job creation, and overall economic growth.

Stimulus packages can also have an impact on the stock market, as investors often see them as a signal of economic stability. This, in turn, can increase confidence and lead to higher stock prices. However, the impact on the stock market is often short-lived, as it’s subject to market fluctuations and other external factors.

Another potential impact of government stimulus packages is inflation. By increasing demand in the economy, governments run the risk of driving up prices, leading to higher inflation. This can be especially problematic if the economy is already experiencing a period of high inflation.

Case Studies

To gain a deeper understanding of the impact of government stimulus packages, let’s take a closer look at some notable case studies from around the world.

The New Deal (1933-1938)

As mentioned earlier, the New Deal was one of the first and most significant examples of government stimulus packages. In response to the Great Depression, President Franklin D. Roosevelt implemented a series of programs and policies that aimed to create jobs, provide financial assistance to those in need, and stimulate economic growth.

The New Deal included various forms of government spending, such as infrastructure projects, public works programs, and agricultural subsidies. It also introduced social welfare programs such as Social Security and unemployment benefits. While the full impact of the New Deal is still debated, many believe it played a significant role in stabilizing the U.S. economy and laying the foundation for future economic prosperity.

The Economic Stimulus Act (2008)

In response to the 2008 financial crisis, the U.S. government passed the Economic Stimulus Act, which provided tax rebates to individuals and businesses. The act also included measures to support unemployment benefits, food stamps, and infrastructure spending. The total cost of the act amounted to $168 billion.

While the stimulus package was intended to boost consumer spending and revive the economy, its impact was minimal. Some experts argue that the size of the package was not enough to make a significant impact, while others believe that the money was not spent effectively. Regardless, the lesson learned from this case study is that the size and design of a stimulus package are crucial in determining its effectiveness.

The European Recovery Program (1948-1952)

Also known as the Marshall Plan, the European Recovery Program was a massive aid program initiated by the U.S. to support the economic recovery of European countries after World War II. The plan provided financial assistance to 16 countries and totaled over $15 billion (equivalent to around $150 billion today).

The Marshall Plan was a successful example of government stimulus packages, as it helped to rebuild war-torn economies and strengthen political ties between the U.S. and Europe. It also had a significant impact on global trade and laid the foundation for future economic growth.

Criticisms and Controversies

Despite their widespread use, government stimulus packages have faced criticism and controversy over the years. Some of the key points of contention include:

Political Influence

One of the most significant criticisms of government stimulus packages is that they can be influenced by political agendas rather than economic needs. In some cases, politicians may use stimulus packages to gain votes or support certain industries or regions, leading to inefficient use of funds and potential long-term consequences.

Fiscal Responsibility

Another common argument against stimulus packages is that they can lead to excessive government spending and deficits. While these measures may provide short-term relief, they can also contribute to long-term debt and further economic instability. Critics argue that governments should focus on fiscal responsibility and maintaining a stable budget rather than relying on stimulus packages.

Limited Impact

As mentioned earlier, measuring the impact of government stimulus packages can be difficult, and their effectiveness is often debated. Critics argue that these measures have a limited impact and that their benefits are short-lived. They also point out that stimulus packages can create artificial demand and distort market forces, leading to unintended consequences.

Future of Government Stimulus Packages

In the face of economic crises such as the 2008 financial crisis and the ongoing COVID-19 pandemic, governments are once again turning to fiscal policy tools such as stimulus packages. While the future effectiveness of these measures may be uncertain, one thing is clear: government stimulus packages will continue to play a significant role in shaping our economies.

As we move towards a more globalized economy, it’s likely that we’ll see more collaboration and coordination between countries when it comes to implementing stimulus packages. This can help to mitigate the impact of economic downturns on a global scale and lead to more effective use of resources.

Additionally, technological advancements, such as artificial intelligence and automation, may also have an impact on how stimulus packages are designed and implemented. As the nature of work continues to evolve, governments may need to find new ways to stimulate demand and support those affected by job losses.

Conclusion

In conclusion, government stimulus packages are a vital tool in a government’s economic arsenal. While their effectiveness may be debated, there’s no denying that they have played a crucial role in stabilizing economies throughout history. By providing a short-term boost to demand, governments hope to create a ripple effect throughout the economy and lay the foundation for long-term growth and prosperity.

However, with great power comes great responsibility. The design, size, and implementation of stimulus packages are critical in determining their impact and ensuring they don’t have unintended consequences. As we navigate through times of crisis and uncertainty, it’s crucial for governments to carefully consider the use of fiscal policy tools such as stimulus packages and ensure they are used responsibly and effectively.